Arizona Real Estate in 2025: How Economic Headwinds Are Shaping the Market—and What Realtors Should Watch

By Sean Colón

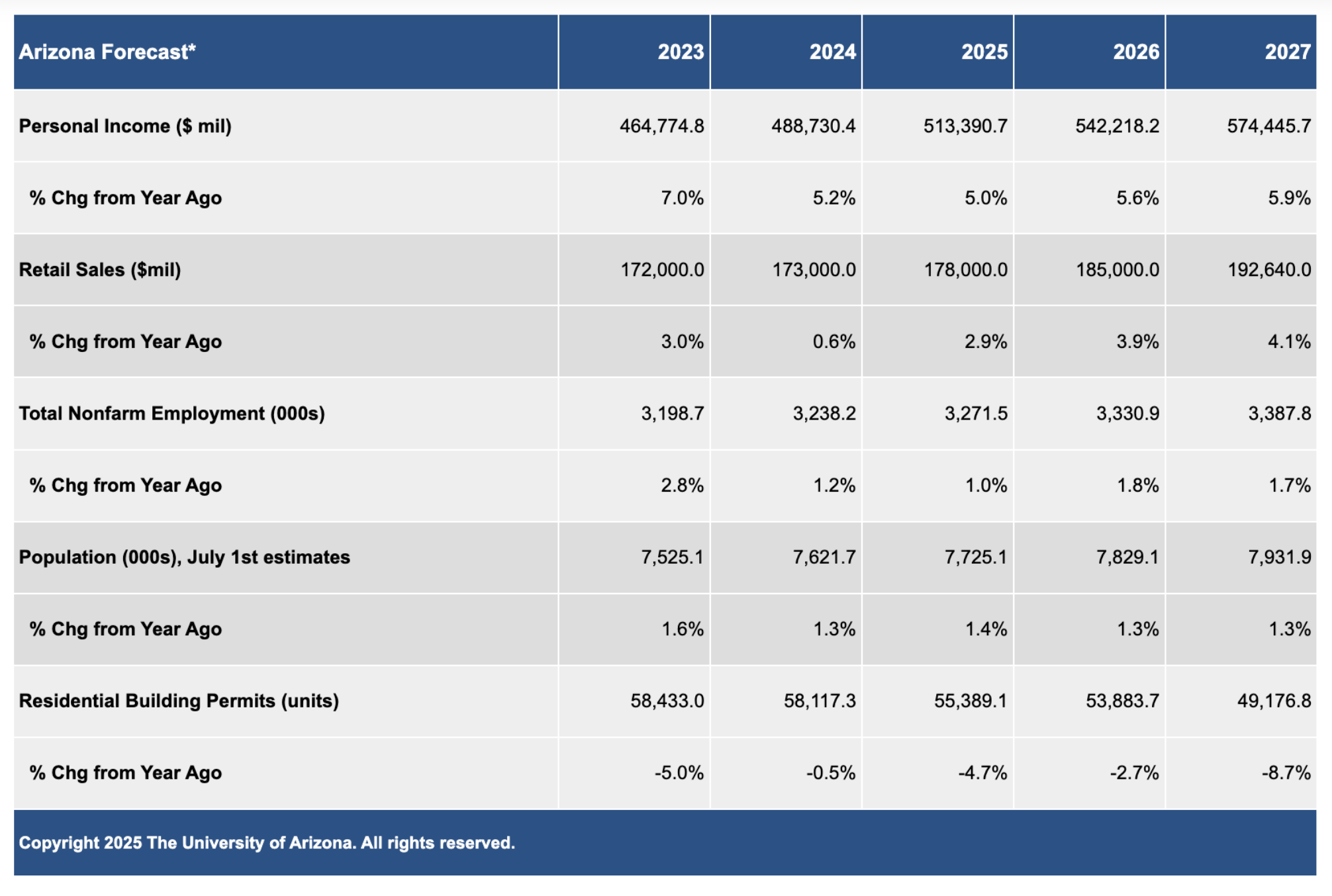

Arizona's real estate market is facing an economic deceleration, but that doesn’t mean opportunity has dried up—it just means agents need to pivot. With job growth slowing to 1.3% in 2024 (down from the initially projected 2.1%) and only a modest 1.0% expected for 2025, the state’s economy is in a holding pattern. Add in housing affordability issues—where the average Phoenix buyer now spends 47.5% of their income on a mortgage—and it’s clear that Arizona realtors need to be strategic, informed, and proactive.

What’s Really Going On in Arizona’s Economy?

Recent revisions paint a more subdued picture of Arizona’s economic growth. While 2023 ended stronger than expected, 2024 showed only average job creation, even in major metros like Phoenix and Tucson. Professional and business services saw notable job losses, while construction and healthcare posted gains. This divergence means local market knowledge is more important than ever.

Despite these shifts, unemployment remains low and labor market churn is down, suggesting that while growth is slow, the economy isn’t collapsing. However, uncertainties in federal policy—especially around tariffs and immigration—have raised recession concerns.

Quick Stats:

Arizona job growth (2024): Revised to 1.3%

Housing permits statewide Q1 2025: Down 14.4%

Phoenix housing permits Q1 2025: Down 17%

Phoenix home prices April 2025: $445,000 median, down 1.1%

Housing affordability in Phoenix: 47.5% of median income spent on mortgage

Consumer inflation in Phoenix: 0.3%, far below the national average

What Arizona Realtors Need to Know

This isn’t a market to panic in—but it is a market to read carefully. For realtors, that means leaning into local data, fine-tuning pricing strategies, and doubling down on your value as an expert guide through a confusing environment.

How to Stay Ahead:

Educate sellers on updated pricing expectations. A 1–2% annual dip in home values isn’t catastrophic, but it does affect list price strategy.

Highlight affordability programs for buyers, especially first-time or lower-income clients. The Arizona Industrial Development Authority offers multiple tools and grants.

Advocate for builders to use targeted marketing, especially in areas like Tucson where permits are up but prices have dipped slightly (down 1.6% YoY).

Adapt to buyer psychology. With affordability strained, today’s buyers are more cautious and financially constrained—understanding this can help tailor your approach and close more effectively.

The Road Ahead: 2026 and Beyond

The baseline forecast anticipates a rebound by 2026, with Arizona job growth returning to a healthier 1.8%. But between now and then, success will depend on how well realtors navigate a cautious but stable environment.

Population growth, the primary driver of Arizona housing demand, is expected to continue—though modestly. As net migration slows and housing costs remain high, expect continued pressure on affordability and slower momentum in permitting.

Takeaways for Arizona Agents

Know your local numbers. Prescott is seeing sales growth, while Tucson is facing job losses—blanket strategies won’t cut it.

Communicate confidence. Clients are overwhelmed by headlines. Be the calm expert who has real answers.

Offer solutions. Whether it’s staging, pricing, or financing options, agents who solve problems are the ones who win business in a cautious market.

By the way, I help realtors improve their online and social media presence by providing beautiful photos of their listings. That is why I’ve created this FREE HOME PREP LIST for your clients to help your listings look their best. Feel free to share.