June 2023 Phoenix Real Estate Market: An Update for Buyers and Sellers

By Sean Colón

Welcome to our June 2023 update on the Arizona real estate market, specifically focusing on the Greater Phoenix area. In this blog post, we'll delve into the latest statistics and trends that impact both buyers and sellers. From supply dynamics to mortgage rate fluctuations and market conditions, we'll provide expert insights to help you navigate the current landscape successfully.

Buyers:

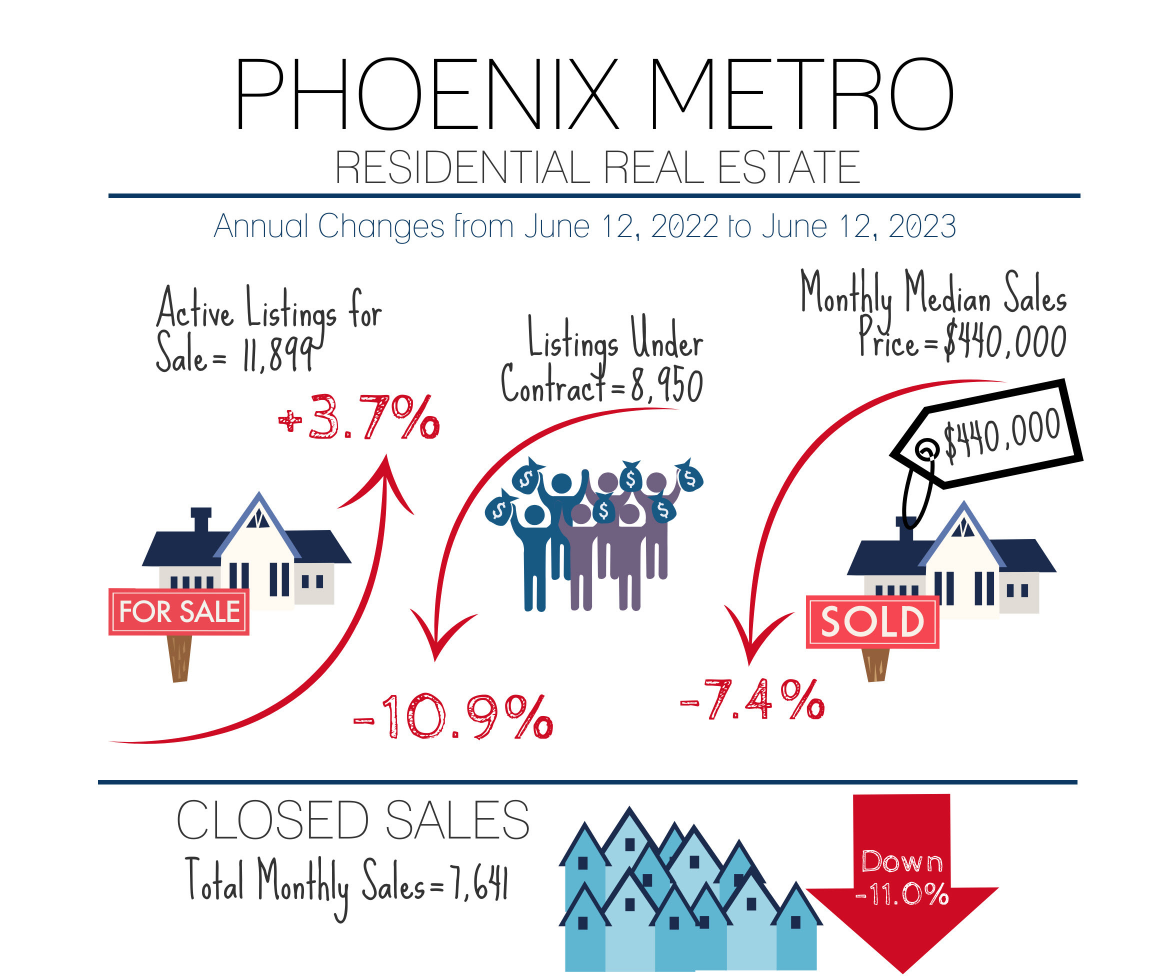

The housing supply in Greater Phoenix is rapidly declining, with last month's data indicating a negative year-over-year supply change within just six weeks. Compared to the previous year, the current supply is only 3.7% higher, and it is expected to dip below the 2022 level very soon. Insufficient new listings are failing to keep up with the demand, resulting in an average decline of 151 listings per week in the last month. Although the rate of decline has slowed, it is not due to an increase in sellers listing their homes. Rather, it is a response to a temporary weakening of demand caused by a sudden spike in mortgage rates. Despite the recent instability, FHA buyers now have an advantage as investors have scaled back their activities, allowing traditional buyers to take the lead. FHA has increased its loan limit to $530K and lowered mortgage insurance premiums, making it an attractive option for many buyers.

Sellers:

Despite the recent increase in mortgage rates, prices in Greater Phoenix continue to rise and are expected to do so for the next 3-5 months. While still down compared to the previous year, the median sales price has seen a recovery of 5% since December, amounting to a $22K increase. This positive trend suggests that annual appreciation rates will soon turn positive once again. Nearly every city in the region is now considered a seller's market, with Maricopa and Buckeye transitioning from buyer's markets to balanced markets. Casa Grande remains the only city still classified as a buyer's market. As the market correction progresses, the shift in these outlying areas signifies the market's return to balance. Sellers, while benefiting from improving market conditions, still contribute to closing costs and rate buydowns to facilitate transactions. Over 50% of sales in the $200K-$500K range involve sellers contributing to buyers' costs, with a median contribution of $7,500 this month.

Conclusion: The Greater Phoenix real estate market continues to evolve, presenting both opportunities and challenges for buyers and sellers alike. As a realtor, staying informed and adapting to changing conditions is crucial to your success. By closely monitoring supply dynamics, mortgage rate trends, and market conditions, you can better position yourself to serve your clients and make informed decisions. Remember, the Phoenix market remains appreciating largely due to the willingness of sellers to offset closing costs. As the market progresses, it's important to leverage these insights and provide exceptional service to ensure successful transactions for your clients.

Note: The statistics and information mentioned in this blog are based on the data available at the time of writing. For the most accurate and up-to-date insights, it's recommended to refer to reputable real estate sources and consult with local experts.

Graphic: Cromford Report. (June 2023). Retrieved from https://cromfordreport.com/

By the way, I help realtors improve their online presence by providing beautiful photos of their listings. That is why I’ve created this FREE HOME PREP LIST for your clients to help your listings look their best. Feel free to share.